[ad_1]

IN THE automotive business, few pivots are as dramatic as the one pulled off by Hong Seh Group.

Singapore’s long-time dealer for Ferrari and Maserati lost the Italian crown jewels of its luxury car portfolio in 2009 and 2017, respectively.

Some industry observers saw no path forward for the family-owned company as the two brands encompassed almost all its automotive business.

As it turned out, Hong Seh found something better: a new market that could be worth US$80 billion in a decade.

Through its subsidiary Hong Seh Evolution (HSE), the company boasts the widest portfolio of Chinese automotive brands on the Singapore market; and it plans to capitalise on the wave of electrification coming to Asean.

Lightning strikes

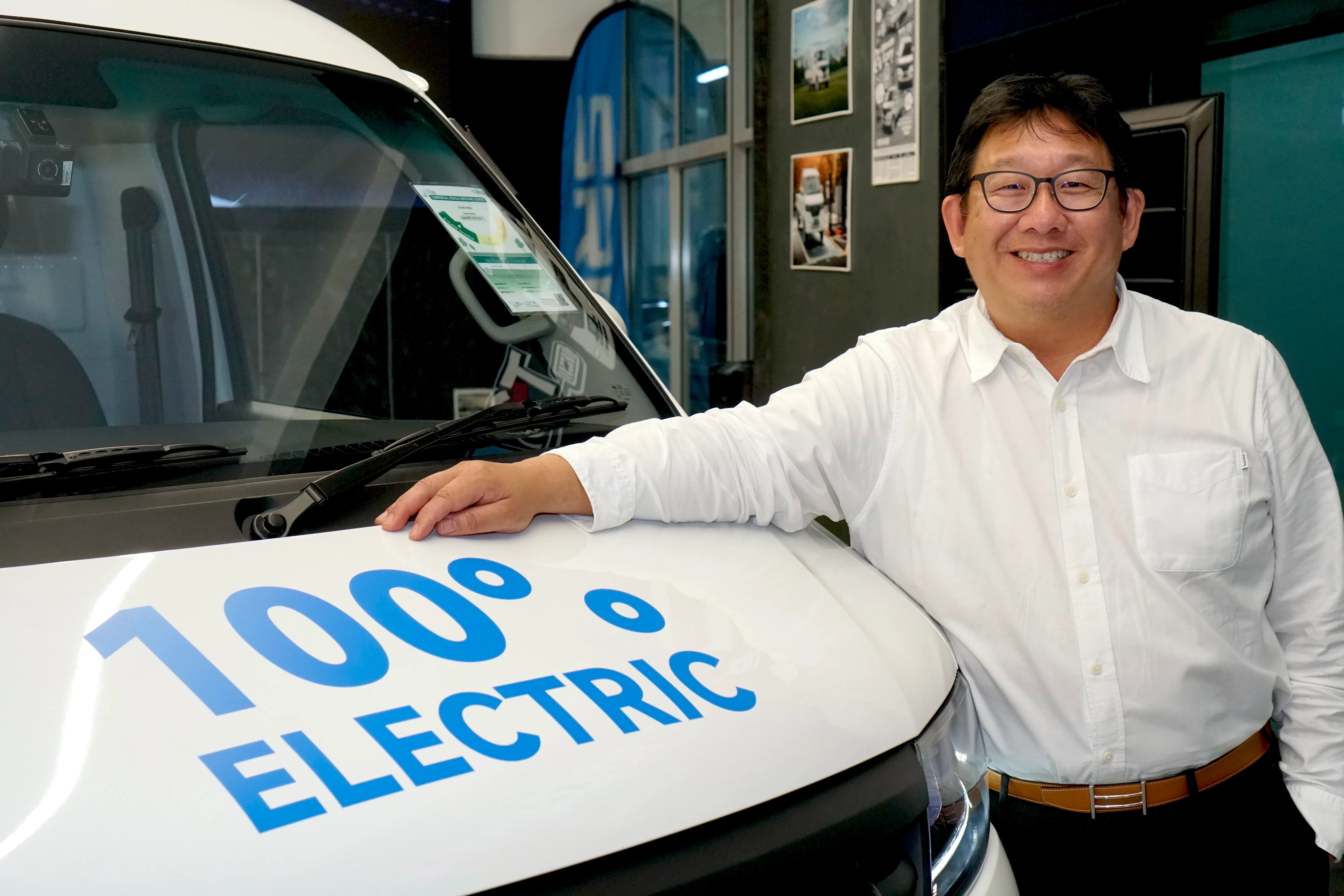

Edward Tan, executive director of Hong Seh Group, says the company is no stranger to diversification.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Chop Hong Seh was founded by Tan’s grandfather as a hardware shop in 1936. The company later transitioned to plastics and chemicals under Tan’s father Alfred, who is also Hong Seh’s managing director.

In the 1980s, Tan’s father foresaw the burgeoning market for luxury cars and pitched for the Ferrari dealership.

Tan found similar inspiration in 2017, when he drove a Tesla for the first time. Hong Seh was bringing Tesla cars into Singapore three years before the American brand officially arrived.

Even as he was impressed by their performance, Tan realised electric vehicles (EVs) possessed another important advantage: they would be far cheaper to run than conventional vehicles. That made them particularly attractive in commercial settings, where the bottom line is king.

Braving new currents

HSE focuses on offering competitively priced EVs that break new ground for commercial customers. Its first such offering was BYD’s T3 electric light-goods vehicle.

The T3 was well received, strengthening Tan’s conviction in cost-effective Chinese electric goods vehicles. HSE began looking for more opportunities.

“We started going to China looking for other manufacturers, because we learned that electrification started much earlier in China. Their government has been massively pushing electrification, and almost all the new commercial vehicles and passenger cars there are electrified. We saw, and were convinced, that electrification can be done,” he says.

Exploring a foreign market to establish equally new partnerships is difficult, but the process was made easier by working with UOB.

“The bank has been very helpful. UOB is well trusted and well established in China, and they are familiar with Chinese companies. Not only could they help with checks on the (automotive) manufacturers; they helped us with tradelines through letters of credit and trust receipts,” he adds.

The latter two were especially useful when it came to forging new partnerships.

“Trust is very important in creating new business relationships, but at the start of the relationship it is even more so. You can trust (the new partner); but for money, payments on shipments, you have to use letters of credit and trust receipts, and have a good bank backing you,” says Tan.

Customised solutions

In the past three years, HSE has added a number of brands to its stable. It is now the authorised distributor for seven Chinese automotive manufacturers in Singapore: Ankai, DFSK, Farizon, Joylong, LEVC, SRM and Seres.

With the exception of Seres, which is a passenger car brand, HSE’s distribution for these brands is focused on commercial vehicles.

The wide range of brands has been shaped by HSE’s strategy of filling niches and offering a wide choice of fully electric goods vehicles, ranging from light vans to buses to lorries.

Farizon, for example, was brought onboard in late 2023 and targets the nascent electric heavy-goods vehicle market with its T9E lorry.

Tan emphasises that HSE’s approach is not just about filling gaps, but meeting the needs of clients and delivering more value as well.

“Number one, it needs to be electrified. Two, it must meet the customer’s needs,” says Tan on the criteria for HSE’s products.

He also cites the example of the SRM T3EV – a 10-foot lorry positioned to compete with the most popular conventional lorry here, the Toyota Dyna.

HSE worked closely with SRM to ensure the vehicle was able to be price-competitive while also having a larger load space and being able to carry more passengers.

“This (version) is something that does not exist in China at all. We actually had to work quite long and hard with the factory to come up with the dimensions, with the payloads, with the specs,” he says.

Sparking ahead

A vehicle distributor typically bridges the gap between vehicle manufacturer and retail dealers, but Tan sees HSE as able to add more value by working with Chinese manufacturers that are new and hungry for market share.

“SRM, for instance, has been very accommodating,” he says. “They have been working with us to customise and refine the vehicles throughout their lifecycle with constant improvements. In the automotive industry, there are some one-sided relationships (with manufacturers). This is definitely two-sided.”

The outcome is better products, which is a win for all involved: manufacturer, distributor, dealer and client.

HSE aims to replicate this model to become a regional player in the electric goods vehicle realm, and is planning “specialised projects” throughout Asean with Chinese manufacturers.

“We can do things in Malaysia, Thailand, anywhere where there’s a need or want; we can aid with our speciality of learning the local market, working with the local people, and then being the bridge between that country and China.”

Analysis from consultancy EY-Parthenon forecasts the Asean-6 (Indonesia, Malaysia, Thailand, Vietnam, the Philippines and Singapore) EV market to grow at a compounded 16 to 39 per cent per annum between 2021 and 2035.

Sales are forecasted to hit between US$80 billion and US$100 billion by 2034, up from around US$2 billion in 2021.

“We see a lot of potential in the Singapore market; but regionally, even more so. Asean has only just begun to catch on to EVs, and in the commercial vehicles they will have even more of an impact than passenger cars on reducing pollution,” Tan adds.

Environmental benefits are the most important benefit of EVs, in Tan’s opinion, and have changed the way he looks at vehicles and transportation.

“I’ve got a four-year-old daughter. We all want to leave the planet in the same condition or better for the next generation,” says Tan. “We are only taking care of it for the time being.”

SIDEBAR: UOB’s U-Drive steering green transport solutions

As a forerunner in the electrification journey, UOB collaborated with Hong Seh Evolution (HSE) to launch U-Drive solutions back in 2021.

UOB also granted green trade financing as well as floor stock financing to HSE to facilitate its trade cycle.

Through U-Drive, UOB today provides a comprehensive set of solutions and partnerships across the electric-vehicle (EV) ecosystem – including component suppliers, dealers, charging operators, fleet owners and individuals.

The benefits include reductions in operating costs and CO2 emissions reductions by adopting EVs, flexible financing that helps to simplify the electrification process, and other services to help support more EV adoption and brand penetration.

Eric Lian, UOB’s head of group commercial banking, says: “UOB believes in the transformative power of sustainable finance. Our collaboration with HSE through the UOB U-Drive solution is a testament to our commitment to support businesses in their green journeys. Our green trade financing not only facilitates HSE’s trade cycle but also reinforces our dedication to creating a more sustainable future.”

[ad_2]

Source link