[ad_1]

IT WAS a whirlwind anti-money laundering bust involving billions of dollars that took Singapore by storm.

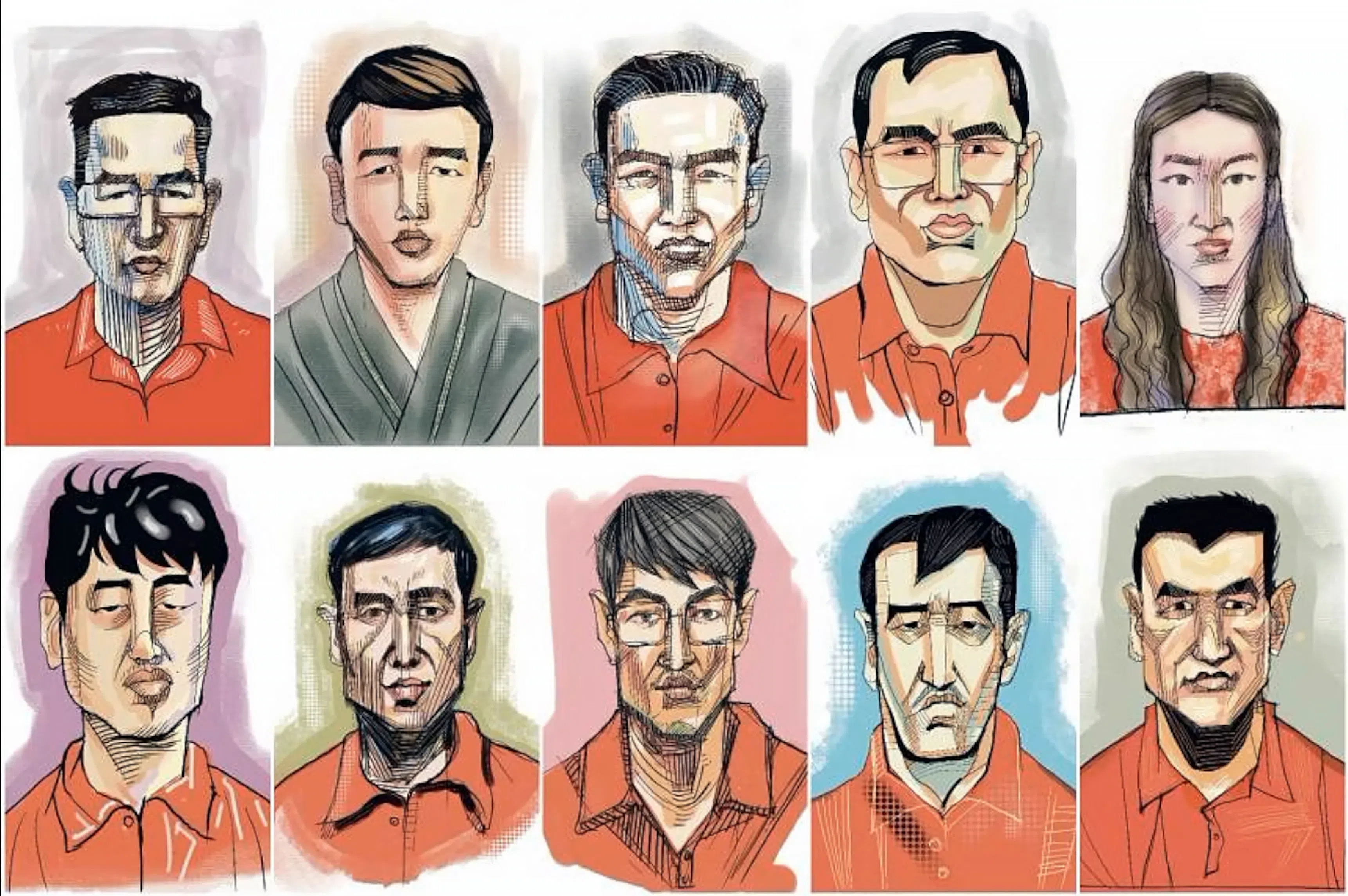

Now, nearly 10 months after an islandwide blitz that involved over 400 officers from various police departments, the 10 foreign nationals that were arrested have been sentenced to jail.

The last of the 10, Su Jianfeng, was on Monday (Jun 10) sentenced to 17 months, backdated to his date of arrest – Aug 15, 2023.

Some members of this group involved in Singapore’s largest ever money laundering case have been deported upon completion of their terms.

“The swift prosecution of these 10 cases is a strong message to would-be criminals that Singapore will not tolerate attempts to flout our laws,” said chief prosecutor Tan Kiat Pheng.

“We will take firm and swift action against those who exploit our system to launder illicit gains or commit white-collar crimes.”

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

The 10 money launderers – Su Haijin, Su Baolin, Su Jianfeng, Su Wenqiang, Vang Shuiming, Chen Qingyuan, Zhang Ruijin, Wang Dehai, Wang Baosen and Lin Baoying – were sentenced to between 13 and 17 months’ jail on charges related to money laundering, fraud and forgery.

Members of the group were nabbed from their residences, which included rented Good Class Bungalows or condominiums in Bukit Timah, Orchard Road and similar neighbourhoods.

In a bid to escape, Cambodian passport holder Su Haijin fled through his second floor balcony. He sustained fractures for the attempt, and was later photographed being hauled out of his Ewart Park bungalow.

About S$1 billion in assets were initially seized or issued prohibition of disposal orders, which means they cannot be sold. The variety of assets ranged widely – property, luxury goods, vehicles, cash, as well as bank accounts with several financial institutions.

A few had several cryptocurrencies, or held country club memberships worth thousands of dollars; Su Haijin and Lin Baoying had a collection of Bearbricks figurines, which stole headlines when the police released images of the seized assets.

The initial S$1 billion in assets – an already eye-watering amount – ballooned to S$3 billion as more investigations were carried out.

Nearly S$650,000 was spent to maintain the seized assets, Minister for Home Affairs and Law K Shanmugam said in May this year.

Who are the 10?

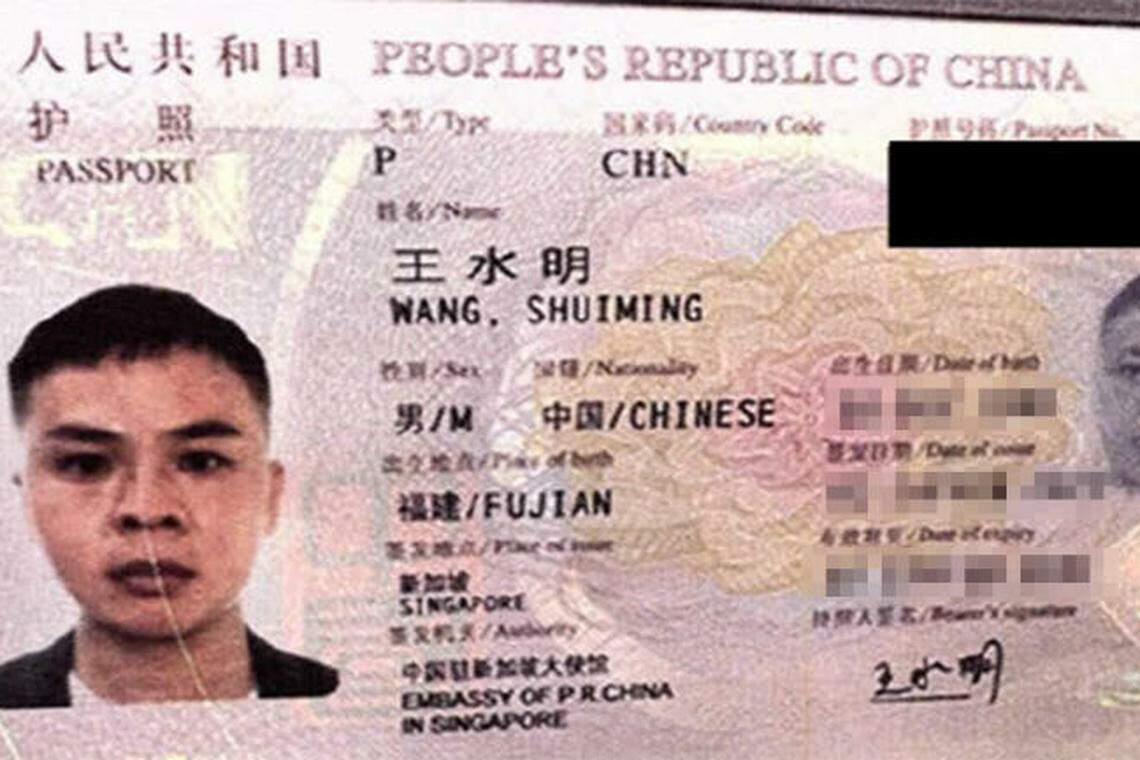

The group is believed to hail from Fujian, China, but held multiple passports from countries such as Cambodia, Vanuatu, St Kitts and Nevis, and Dominica – countries where individuals could obtain passports through significant investments.

Lin, the only woman among the 10, had paid US$290,000 to agents to obtain her Cambodian and Dominican passports. She had not visited the latter before obtaining the passport.

Investigations showed that several members of the group were connected, said the police.

Many were also part of unlawful remote gambling operations in the Philippines, which offered online gambling services to people in China. Online gambling in China is illegal.

After relocating to Singapore, the 10 had laundered their ill-gotten gains by purchasing property and other assets. They aimed to stay in the Republic in the long term, bringing their families with them – several told the Singapore court that they wished to enrol their children in the education system here.

Beyond money laundering, the 10 also forged documents to dupe financial institutions and government bodies. False statements claiming property sales or loans were submitted to banks to explain away large deposits of money; lenders also received inflated financial statements from companies with no true business operations.

The Ministry of Manpower (MOM) and other authorities were similarly furnished with false documents. For example, Su Wenqiang was found to have possessed a forged marriage document from China as a supporting document for a dependent pass application to MOM.

Cambodian passport holder Su Baolin declared to MOM that his wife would be employed at a company known as SG-Gree. However, she had no intention of working there, the court heard.

They also did not commit the crimes alone. The court heard that Chen Qingyuan engaged in a conspiracy with Wang Qiujiao, his girlfriend, to submit forged documents to cheat Standard Chartered Bank.

Su Baolin conspired with former Citibank employee Wang Qiming to make a false document with the intention to cheat Standard Chartered Bank.

He also worked with filing agent LW Business Consultancy’s qualified individual Wang Junjie to make false representations to the Inland Revenue Authority of Singapore. Wang Junjie’s registration was later cancelled.

At the courts

Early in the court proceedings, the 10 sought several times to be released on bail.

Prominent names in the legal world were hired, including lawyers from Drew & Napier, Lee & Lee, K&L Gates Straits Law and Eugene Thuraisingam. Each lawyer raised several points on why their clients should be let out on bail, proposing conditions including electronic tagging and having their whole families surrender their passports.

Two of the 10 – Su Haijin and Su Baolin – also had medical conditions that their lawyers brought up in arguments: Su Haijin had sustained fractures after his escape attempt, while Su Baolin had a congenital heart condition and a growth in the large intestine that had a cancer risk.

In each case, the State Courts decided that the 10 individuals should be denied bail. They agreed with the prosecution that the 10 were flight risks with tenuous links to Singapore.

For the cases of individuals with medical conditions, the judges found that the prison was equipped to handle their injuries or illnesses.

When the State Court reviews failed, one individual – Vang – turned twice to the High Court to be let out on bail, claiming that the order for no bail was erroneous. Justice Vincent Hoong dismissed the application both times, adding that the court would be “extremely reluctant” to grant bail in subsequent applications.

Once the first money launderer – Su Wenqiang – indicated an intention to plead guilty on Mar 7, the remaining nine launderers quickly followed suit. Several of them forfeited a large amount of their seized or frozen assets, with Su Wenqiang and Wang Baosen giving up all their assets as the sum was under S$10 million.

In deciding the sentences, the court weighed the early plea of guilt from these individuals and forfeited assets against the need for general deterrence, to ensure that Singapore’s reputation as a financial hub was maintained.

The district judges also took into account aggravating factors, such as the transnational element and the substantial sums involved. This led to the 13 to 16 months’ jail terms handed to the 10 money launderers.

Shanmugam said in May that the sentences meted out at the time were comparable to those in other jurisdictions.

“The amounts involved across these 10 matters make this the largest money laundering case that Singapore has prosecuted,” said chief prosecutor Tan.

“We will continue to work closely with our law enforcement agencies and regulator to safeguard Singapore’s hard-earned reputation and integrity as a global financial hub.”

[ad_2]

Source link