[ad_1]

TOTAL securities market turnover value on the Singapore Exchange (SGX) climbed 37 per cent year on year to S$25.5 billion in April, the highest since March 2023.

The jump in value coincided with an increase in trading volumes, based on market statistics posted by SGX : S68 0% on Wednesday (May 8).

Total market turnover volumes for the month rose 37 per cent to 37.1 million shares from 18.6 million shares in the same month last year.

Notably, the market turnover value of exchange-traded funds (ETFs) hit a two-year high of S$487 million, surging 96 per cent year on year from S$248 million in April 2023. Volumes were up 101 per cent to 299 million shares from 148 million in the same period the previous year.

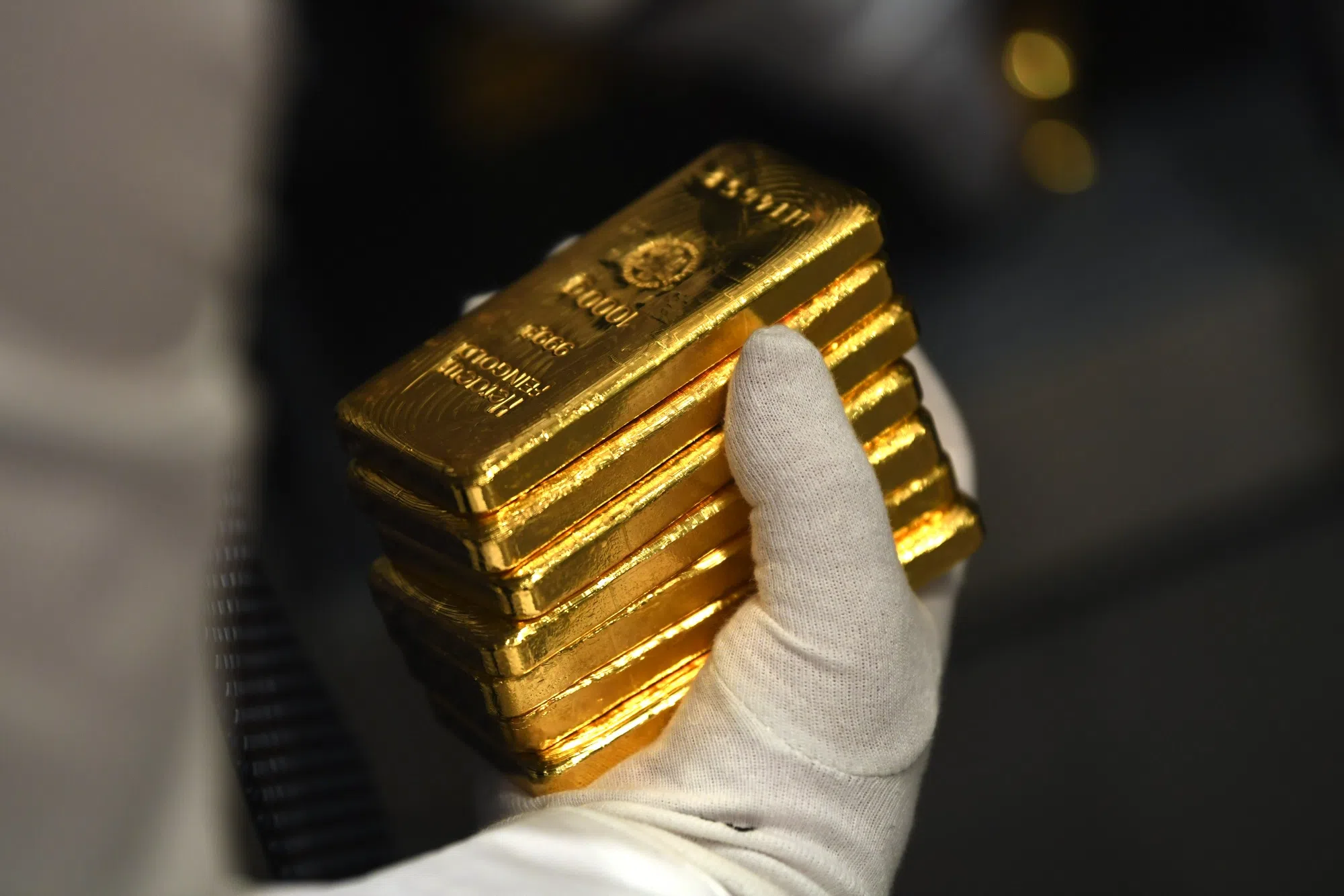

SGX attributed the increase to real estate investment trusts and gold ETFs amid uncertainties over the path for US interest rates.

Securities daily average volume (DAV) for the month reached S$1.2 billion, up 24 per cent from S$979 million in the same period last year, outperforming most South-east Asian markets, SGX said. Volumes, too, were up 24 per cent on the year to 1.7 billion shares from 1.4 billion shares.

GET BT IN YOUR INBOX DAILY

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

SGX also recorded a jump in derivatives volumes in April. Total trading volumes stood at 24.1 million contracts, up 36 per cent from 17.7 million contracts in the same period the year prior.

The bourse operator observed a broad-based growth in derivatives volume across equities, foreign exchange and commodities, it said.

Derivatives DAV, meanwhile, was up 23 per cent on the year to 1.2 million contracts, from 963,603 contracts.

[ad_2]

Source link